👋Meet Your New Market Companion.

We’re so glad you’re here. This newsletter is your new weekly market companion designed to guide, teach and inspire you in the technicals and psychology of the markets.

The mission of this newsletter is not just for you to see how we view the market but more importantly for you to learn. We want you to become the asset. Each and every week you’ll learn the tips and tricks that we use to analyze and maximize our risk-to-reward ratio in the markets. These tips can be studied, backtested and applied to your own trading to gain clarity and find your edge to become a consistently profitable trader.

You see, our drive in Falcon is to help you become the best trader you can be. By being the trader, you have the skillset, and no one can take that away from you. Once you have the skillset, you’ll be unstoppable amidst the countless opportunities in the market.

Your job is to remain teachable, push yourself to learn every day, week by week, until you break through. We will be here by your side the whole way to guide you as much as we can.

Enjoy our full sample post, and don’t forget to secure your 7-day free trial!

🎙️Welcome Message from Mark

Before you continue on into the depths of this wondrous newsletter, give a quick listen to this week’s powerful and ever-grateful voice message from Mark 🎧

In Today’s Edition:

- 👉DXY approaches the upper ray-line

- 📉Shorts: CHFJPY, GBPUSD

- 📈Longs: USDJPY, NZDUSD, XAUUSD, CADCHF

- 🔎Trade Recap: USDJPY Long 4.5% Win

- 💬Member Q&A feat. Oscar Chiwalala

- 📢Falcon FX Premium Newsletter Launch!

- 🧠Expectations of a Trader ft. Steven Goldstein

DXY

Daily

4H

Starting off with the DXY, we can see that the last month or so we have consolidated after breaking out of the ascending structure. If we look at the ray-line on the daily chart that is indicated ~95.51, we are looking to see what will happen at that level. This is the clear liquidity area where we are likely to gravitate before going on the next run to the upside.

Overall there is a medium to longer term bearish sentiment on the DXY that we would be looking to capitalize on the impulsive leg as much as possible. If you glance over on the 4H, we can see our structure clearly and there are two options for this position. [Now granted, we do not trade the DXY we trade the inverse EURUSD]

But you could take a risk entry if the correct criteria presents itself on the base (seems a tad less likely at the moment) or we could wait for the first strong impulse and correction to act as confirmation of the structure to the ride that wave to the upside.

The reason in this case the confirmation flag is a bit more critical is because we can see the bigger structure, with the arcing nature towards the bottom (crucial to act as a bottoming out feature in a reversal pattern), but to also wait to see that the exhaustion is over and the sentiment has shifted. Remember, the market isn’t going anywhere, there will usually be more than one entry and there’s a time and place for each one. Some require aggression and some require precision and you’ll learn the differences overtime as you are exposed to more and more trades.

Weekly Watchlist

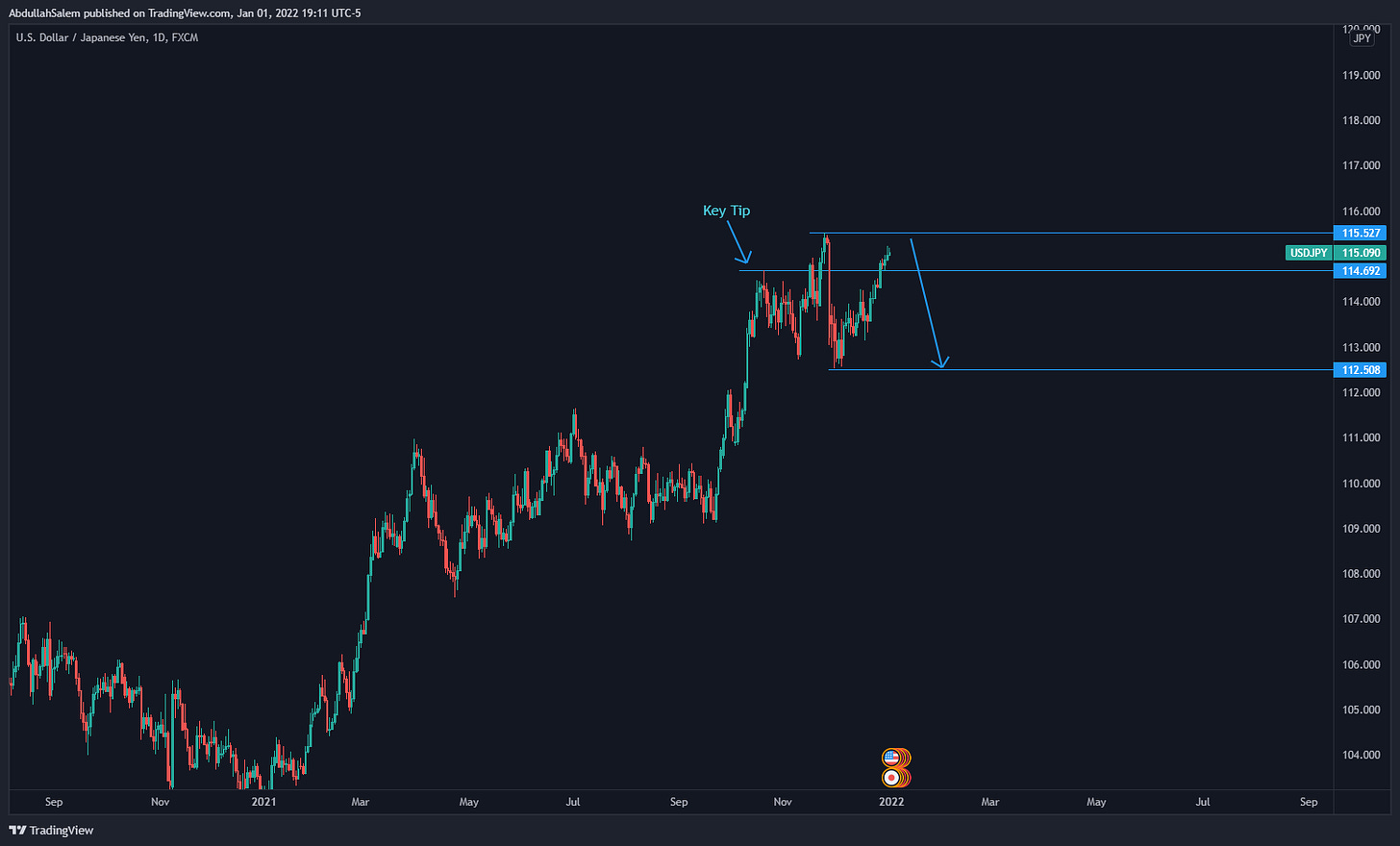

Pair #1: USDJPY SHORT

Taking a look at this daily, we have two critical things to discuss. We could be heading to the most upper ray-line at roughly 115.51 where we would be looking for a risk entry to take the position.

The criteria for this would be a structured approach to the area of value and seeing if we are able to get in precisely to not only protect our risk but to maximize the risk to reward for the position. This is a very simple position that could be ready more towards the middle of the week depending on how long it takes to develop.

There’s something important I want you to pay attention to and that is the key tip. The key tip in this situation is that we could be creating a very large head and shoulders and the thing to note about it, is that the right shoulder tends to go higher than that of the left shoulder and then breaking back in. That’s why on the 4H I’ve signaled a potential second entry that if we broke impulsively back below the ray-line any continuation could signify that we are not going to the upper rayline indicated and that this move could be starting early so therefore that would be our contingency plan to capitalize on that. There’s plenty of room to the downside, so I wouldn’t be too aggressive with the management on this one but also remember to take a message from the market.

Pair #2: GBP/CAD SHORT

Starting off on the daily we can see a very clear three touch structure. We had a head and shoulders at the top of the pattern which a good added bit of confluence confirming the top of the area.

What has happened next? We can see that we trickled our way out in a more corrective wave. This is actually normal where the start of the leg starts out kind of slow and then suddenly it drops aggressively. In most situations we would have already sold aggressively, but this is taking into account what is happening with this new piece of data.

If you were stuck on the bias that corrective price action must go back up, you may end up missing some big moves. That’s why it’s important to dissect what is happening in price. We can see that amidst the correction we can dissect and find structure.

This is where the detail is in the lower timeframe. If you looked at the daily chart we can see the consolidating range that is obvious on the daily. There’s a higher chance for this to come to the downside because we are moving down with structured price action in corrective form. Therefore we need to be able to enter safely and protected by structure to maximize our risk to reward.

On the 4H we can see two main options is that we will either get the risk entry on the structure or this will breakout early and break back in causing an evolution of price. The actual stop size will likely be somewhere in the 18-30 pip range depending on the entry that the market gives us.

In regards to management I would manage this rather generously given the nature of the price of how it has been moving for now. Until we have a solid break then you can begin to lock in price as is necessary to you on your trading plan.

Pair #3: EUR/GBP LONG

Next on watch we obviously have EUR/GBP. We can see on the daily that we have created a nice double bottom and have started to move up. In this case we are waiting for a push out and a flag as confirmation given that there are still value areas below that could be tackled.

When you’re looking to take a trade, it is important to be wary on the different areas where a trade can go from and where it is likely to go from. We call this The Probable and The Possible. In an ideal world, we would only take trades from the most extreme areas as they would have the highest chance of playing out. But that is ignorant because it assumes that the market only goes from certain areas. It is important to stack the odds in your favor.

In the case of EG we can see we’ve had a full daily retrace with momentum on the daily double bottom and that looks to continue. To make sure this is not a false signal we will look to have a structured flag filtered on the 1H to see if we may be able to set a RRE. This would also give it the feel of an inverse head and shoulders which would be a nice confluence to finish it off.

Pair #4: EUR/NZD LONG

EUR/NZD is an interesting on as the overall structure is an expanding pattern which we are now targeting the third touch to complete. This is a fantastic area as we can see in the middle we are likely to get some sort of continuation to the upside. It seems that more Eur pairs do have some upcoming strength, so from a correlative perspective that also checks a box.

Please do note, we do not take pair correlation heavily into consideration as it is important to treat each pair on their own merit. There are subtle details that you will learn on a week-to-week basis which will compound your knowledge as a trader.

In this case as we can see on the 4H, I have mapped a potential risk entry if we get some sort of structured approach to the value area. We would be able to have a really nice risk to reward at the next inflection area which is incredible while completely protecting our trade thesis which at its core is an important way to mitigate risk while increasing exposure.

This may take a couple of days to be ready so I wouldn’t be rushing to take this on market open.

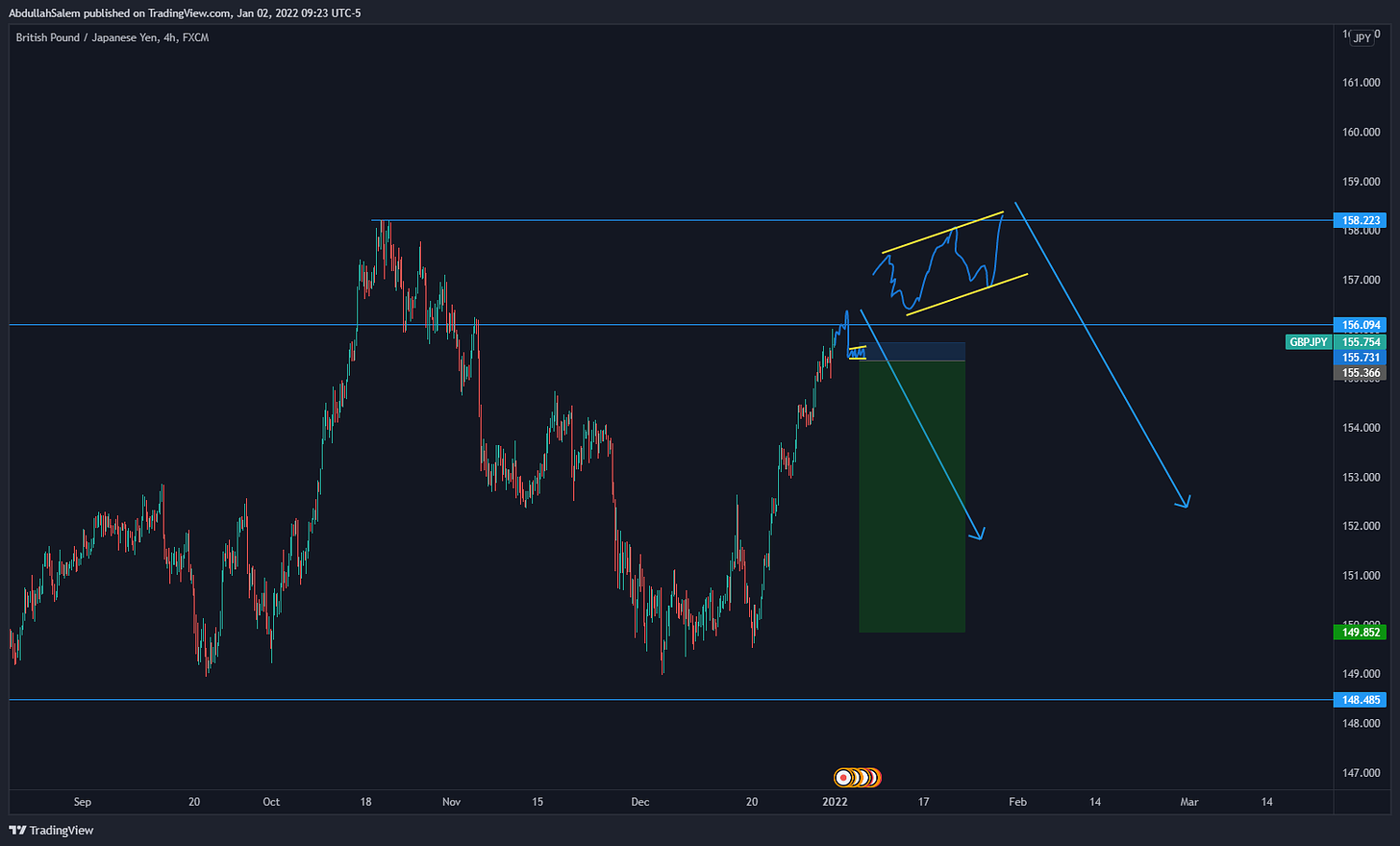

Pair #5: GBP/JPY SHORT

Similar to a lot of the Yen pairs this week, a lot of them seem to be creating some sort of head and shoulders pattern to commit to their next leg. You can see on the daily chart that we’ve put a ray-line where the left shoulder is and this is one that definitely could be ready sooner rather than later.

If you look at the 4H chart, I’ve put on two scenarios. Scenario number one is the one more likely to be ready within a day or so which would be to clear the value area, impulsively push down and get a continuation for us to then be able to set a RRE on the position.

However, given that the daily has been moving in more-or-less a straight line up, I can see exhaustion happening and that we can hang around at the value area for a bit of time before providing an entry to take the trade. That is also why I drew up the second situation on the upper ray-line. That would be a beautifully structured trade, however, that would take roughly two weeks to manifest, which isn’t a bad thing. There is also more opportunities and the market is abundant. That is why it is incredibly important to know your trades from the weekend and sometimes weeks in advance as you are stacking the odds, confluences and probabilities in your favor to ensure you are minimizing drawdown and maximizing upside.

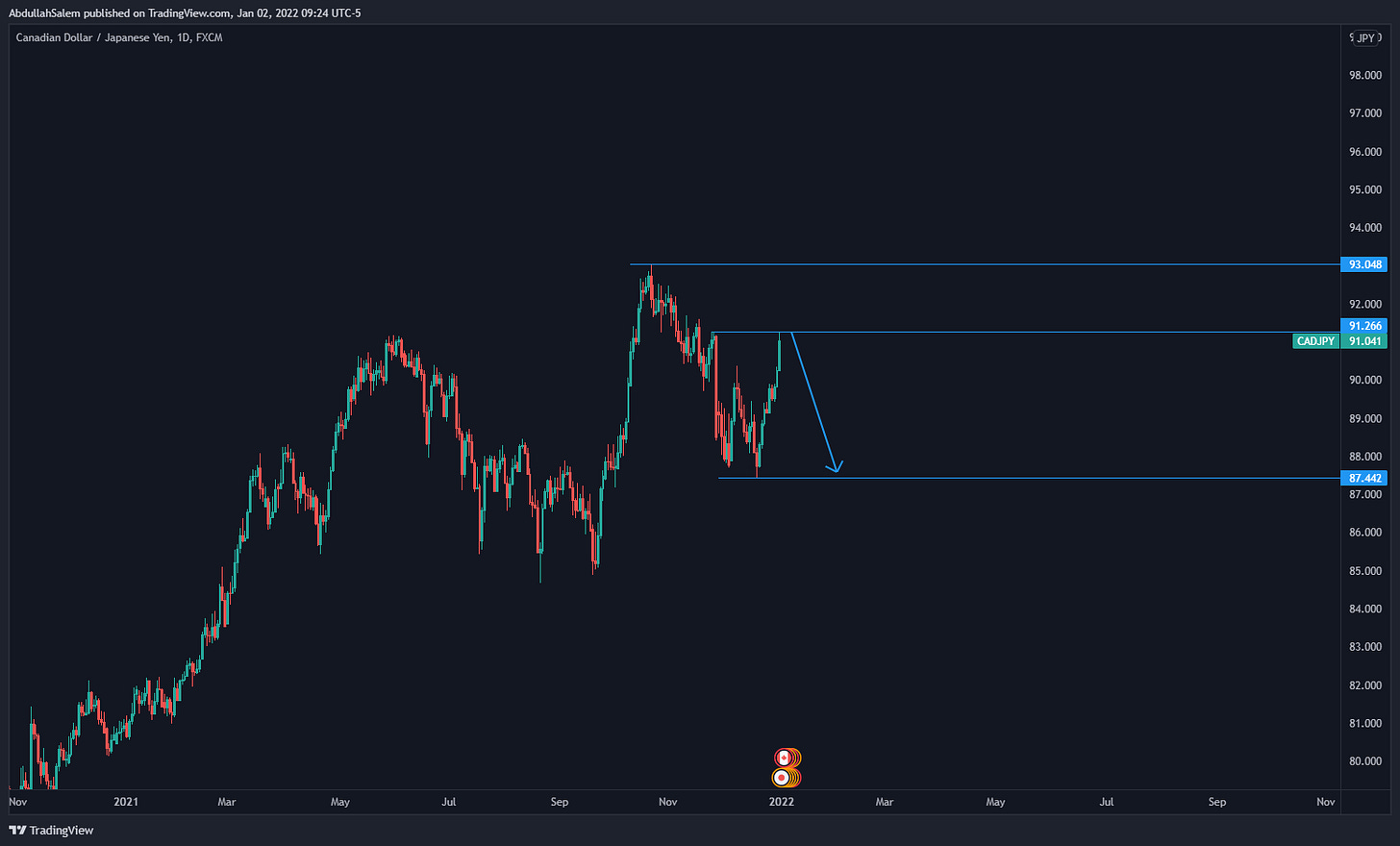

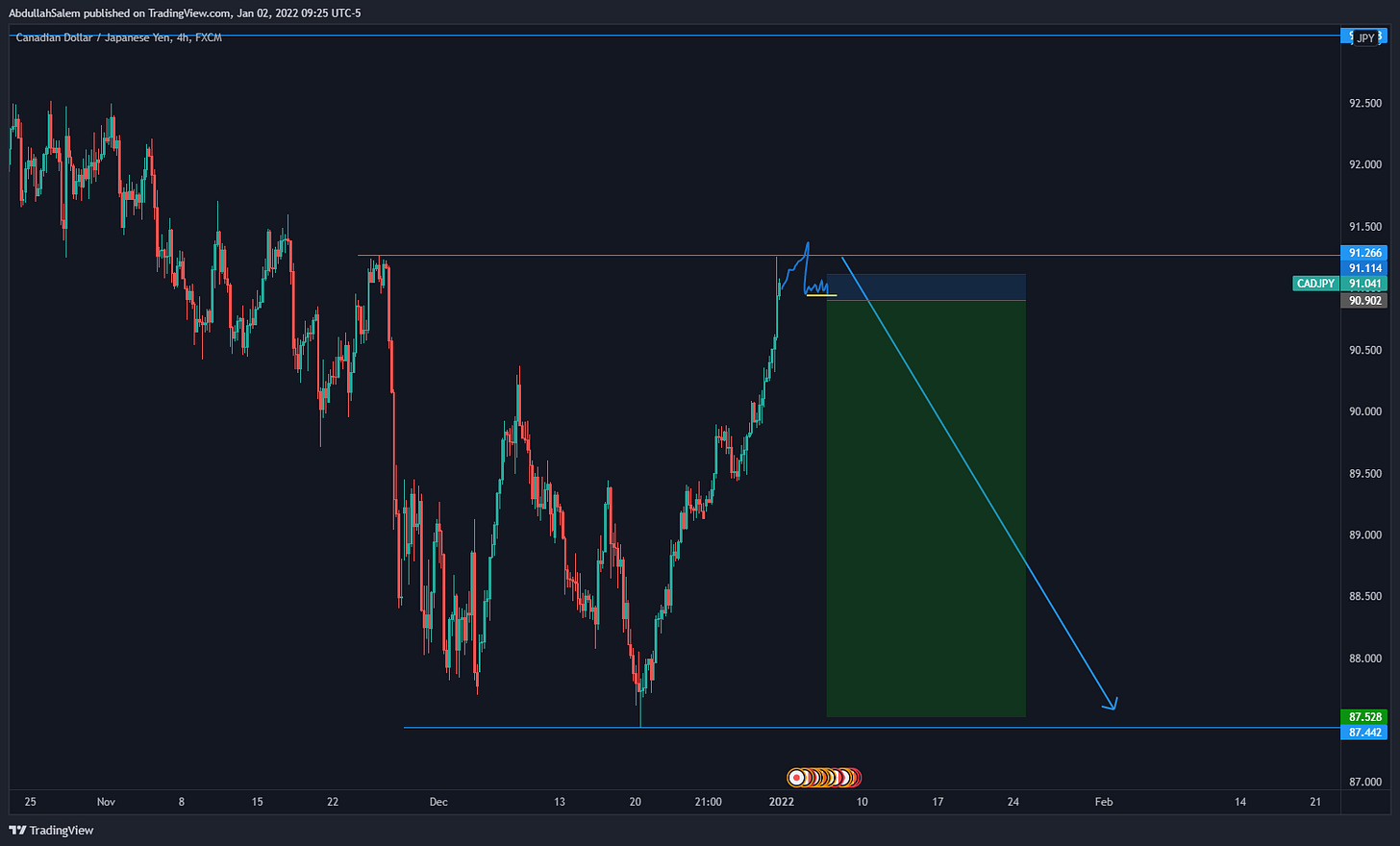

Pair #6: CAD/JPY SHORT

Looking at CAD/JPY daily we can see that we’ve had this leg continue to the upside and is likely to have a pullback. This is also nice as we can see in this week’s watchlist there is a heavy correlation to the Yen and them powering up this week.

Similar to GJ this is one that could be ready sooner rather than later. We will need some sort of confirmation which in this case will be with the push and the flag as confirmation to set the RRE entry. There’s a time and place to use a RE and an RRE which is incredibly important to understand as you have to think of it as moves and counter moves to the market and what is being presented. There isn’t always a right answer but rather something that is more probabilistic to do that will workout in your favor over a longer period of time.

In this case I would take the push down and the flag but I would also manage it somewhat aggressively given that price nature hasn’t stalled for too long and is not necessarily indicating extreme downside apart from the potential Head and Shoulders pattern being created. But even then, as they are created, they take time to manifest and we need to exercise that patience.

But overall, that’s the watchlist for this week ahead! We hope you took some lessons from the key filtering techniques and realizing why we put something on watch versus not putting something else!

Weekly Trade Recap

Pair: USD/JPY +4.5%

Before

Starting off on the daily we can see that we have this clear three touch structure where we’ve also had two candles of lower momentum indicating exhaustion. This is important because we do not have a clear area of value and therefore we have to make sure we have a clear entry signal off our structure which in this case we see the ascending channel with the middle section.

In this case there was a long consolidation due to the low liquidity from the US Bank holiday due to thanksgiving. This caused a lot of low momentum candles and therefore staying out of the first trade was important due to the risk associated with a low liquidity market, such as a flash crash.

Therefore needing permission from the market to enter has become incredibly important. We had the push down and a clear structured consolidation within the flag as well as having our bottoms and a reduce risk entry was then set on the break of the flag and stop well protected. In this case a 15M flag was acceptable as we are early in the run and therefore waiting for a longer consolidation is not necessarily advisable. However, also fomo-ing in and getting in on under-developed consolidations will likely lead to frustration and a bunch of losses.

After

As we can see price plummeted afterwards and I started to move my stop to lock in profit. We know there’s a good chance that this will achieve the 90% rule at the bottom indicated by the blue ray-line. But you have to make sure to not recklessly give back too much profit to the market unnecessarily out of greed. When price plummets as it did, it becomes a bit more difficult to manage as there is then a decent chance where this will then recover and then you all of a sudden give back 5% for no reason. If you are trading high capital you know that 5% is not a small amount and you wouldn’t want to just give it back recklessly.

In this case I managed below the low and it was one of those ones that tagged me to the pip before going on. Just one of those ones. It happens to all of us. Just make sure it is not happening frequently to you because if it is, chances are you are doing something incorrectly.

In the end was tagged out for 4.5% for a quick move.

Falcon Member Q&A

Featuring: Oscar Chiwalala

Oscar’s easily one of the most prolific Falcon members, sharing his insights – trading, psychological, and more – with the greater Falcon community on a regular basis. We chatted with Oscar and talked about a few different aspects of his trading journey.

How long have you been a member at Falcon?

“I just joined Falcon FX back in May 28, 2021… since then its now been seven months being within Falcon FX community.

Personally I am coming from a very humble beginning family from Africa (Moshi-Kilimanjaro, Tanzania) and now I see myself going into reality. The reason of saying so is because Falcon FX has shown me exactly steps on how to set goals and achieve them but more so being a consistent person not only in trading but life in general through trading which is a vehicle for me and as a side effect of that I managed to end last year with 16% profits from all trades I took since joining Falcon with a strike rate of 60% WINS!

At Falcon FX winning is not something of surprise to be honest once you master the skillset, also the Falcon FX Team has laid out the pathway to consistency which I have been following it since day one yet I am still always going back to it to check point my progression and mastering the basics in more advanced way.”

What gives you the drive to get up and pursue trading every single day?

“This is such an interesting question for sure! To be honest for me, it’s about my fellow youth and my brother Mark Hutchinson. I know a lot of people were expecting to speak about my family but that has nothing to do with my drives lol!😄

Mark Hutchinson has shown that succeeding in life is something very simple, and you need just to do those small things in daily basis which normally compound over the long run and hence when we are patient, consistent and working towards our goals, we get good and consistent results. This just been reflected from his Falcon FX Strategy which is very simple to learn but yet effective.

Mark Hutchinson is helping me a lot together with his Falcon FX Team and always looking for the best way possible to help others, so I am always doing the work in order to support their vision and mission, trust me in next 2 – 3 years you will all resonate with me that Mark and his team are changing people’s lives by seeing it

from me, so this for me is a big drive (mark my word… ✍️)”

What are your hobbies outside of trading?

“Wow! I Love Graphic Designs because it normally trains me to be creative and as we all know and understand that creativity its not something we are taught but rather you have to develop it as a person with the skills you possess. This always makes me sharp in the live market condition in terms of thinking in probabilities because with graphic designs also you need to be a good probabilistic thinker, also I do love gospel music composition and singing (tenor)”

What’s been your favorite aspect of the membership experience at Falcon?

“Speaking of Falcon FX aspect is a different story and you can not discriminate one thing over the other as you guys are so creative and know exactly what do give and when to give it, Love your contents always. I would like to start with my experience with community members, then coaches and lastly will pin point on the contents.

The feedback from other community members has helped me massively to grow as a trader and even learning faster.

Falcon FX coaches are so unique that they are willing to work 24/7 just in making sure that we us their students are improving.

I love the Live Webinar Sessions and E-Meets whereby Falcon Fx Members we get together and share our energy and goals but also getting an opportunity speaking with the big elephant in the room Mark Hutchinson.”

If you could give a tip to someone just starting their journey, what would it be?

“I think the things which I can share is that Trading is not a lonely game and I would suggest anyone who is getting started to find a trading community which fits his/her personality and learn while surrounded by like-minded people because there are a lot of up and downs where by you will need a support and some point to people who have been there and have experienced it.”

This interview has been edited and condensed for the newsletter.

What’s Happening at Falcon?

Falcon FX Premium Newsletter Launch

You’re all very well aware of this update… one of the most exciting things we’ve ever done – launch this newsletter!

It’s so cool to see each of you take the next step in your trading journey and sign up for the premium. We’re so confident that this will help complement your trading education and shape you into a better trader.

Quote of the Week

I want to be a pilot – Learn for 5 years

I want to be a Lawyer – Get a degree then learn for 5 years

I want to be boxer – Practice for 4/5 years.

I want to be an athlete – Practice for many years.I want to be a Trader – Start tomorrow.

Any guesses why so many fail??🤔🤔🤔🤔

— Steven Goldstein (@AlphaMind101) February 13, 2020

The Breakdown.

Ah yes. The “get-rich-quick” mentality that’s ravaged the perspective of millions of potential traders.

It never ceases to fascinate me how people’s conditioning blinds them to reality. How many millions of people don’t wince at the idea of attending a 4-year university, accruing $120,000 in debt along the way, for a job that they’re not guaranteed?

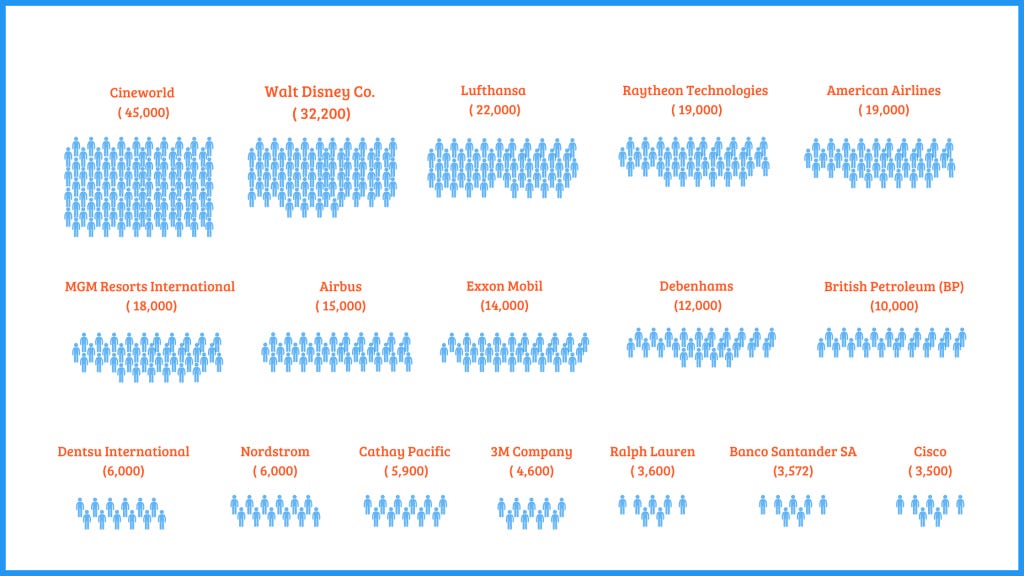

This is often known as the “risk free” path. Yeah, no. Nothing is free of risk. What about the people who actually get the job? Is that when all the risk is eliminated? Nope. Check this out.

Tens and tens of thousands of employees in “safe” jobs, gone. And that’s in 2020 alone. Oh and not to mention the millions of people laid off every month in America. It doesn’t matter what industry you’re in. Traditional does not equal safe.

Back to the matter at hand. 6-figure debt, 4 years of schooling, for a job that we know is not guaranteed. Let’s look at trading. Falcon FX membership costs £97 per month on the high end, or £80.83 per month on the lower end with the annual membership. Let’s do an apples-to-apples comparison. If it took you the same amount of time to reach consistency as a 4-year degree (traders can achieve consistency sooner than this, but for the sake of the argument let’s say 4 years), that would be £3,880. For four years of trading education! Yet people are outraged when they hear that consistency is not something that comes in a few months for free.

We haven’t even considered the consequences of profitable consistency. Unlike traditional careers that, as a reminder, often take 6-figure debt and 4 years of schooling, trading has no profit cap. Account size doesn’t matter anymore thanks to prop firms and funding programs (like our own – available to all Falcon members!), so right now has never been a better time to strive for consistency.

And guess what? You can learn to trade while going to school. You can learn to trade while working. You can learn to trade while being a stay-at-home parent. It doesn’t have to be the endgame. You can use trading to complement your primary source of income (and eventually become primary source of income).

Think of how many more people would be financially free right now if 5 years ago they had the right perception of trading. This is what makes our mission at Falcon, and things like this newsletter, so vital for the trading space. We’re here to change the narrative broadly in the industry, but also individually in the hearts of talented traders across the world. And it’s why we’re so thankful you’re here.

More Free Goodies!

1. Trading Performance Kit: A powerful 3-in-1 tool that can help you track and manage your trades.

2. Our Trader Personality Quiz could help you identify the main obstacles keeping you from success in trading.

3. This list of Mark Hutchinson’s book recommendations with works ranging from Tony Robbins to Benjamin Franklin.

Until Next Time

You did it! You’ve read the entire sample premium Falcon Watch!

Receive emails like this every Sunday morning at 7am (GMT) by signing up below.

Thanks for reading,

– Mark & the Falcon FX Team